Posts

If you choose direct put, go into your own or company account information online 73 for an instant and you will safe lead deposit of the refund (find line 73 tips). You might like either direct deposit to have the financing deposited in to your bank account, otherwise a newspaper view shipped to you personally. For those who marked processing reputation ②‚ and you do not want to use the an element of the overpayment on the partner’s financial obligation because you are simple (legally responsible) because of it, done Function It-280, Nonobligated Mate Allowance, and you will complete it with your unique return.

The brand new registrants

Although not, special flow-as a result of provisions are available so the non-resident is also spread the brand new ITC for the client of your own cupboards should your client are a good GST/HST registrant. The brand new non-resident needs to supply the buyer satisfactory evidence that the GST and/or federal part of the HST are paid off. Which facts boasts Canada Edging Features Company (CBSA) Form B3-3, Canada Tradition Programming Form, the transaction invoice amongst the functions, and you will, if necessary, a signed page regarding the non-resident to your customer demonstrating you to definitely GST or perhaps the government area of the HST is paid back to the cupboards. When the a tradition agent try make payment on luggage fees, the newest products transport services is actually presumably a major international distribution which is zero-rated. The newest broker’s fee on the citizen importer in order to have produced the newest disbursement is subject to the newest GST/HST.

Rent Save Programs

- Because of this the landlord usually do not improve your preferential book more compared to percentage put by the Lease Advice Panel, in addition to one charges for MCIs or IAIs if they pertain.

- You have the to file a proper disagreement for those who differ that have an evaluation, dedication, otherwise choice.

- Providing you supply the registrant an acceptable research one to you paid off the fresh GST and/or government part of the HST after you imported the products, you could spread the newest ITC to that particular registrant.

- To find out more, see Publication RC4034, GST/HST Public service Bodies’ Discount.

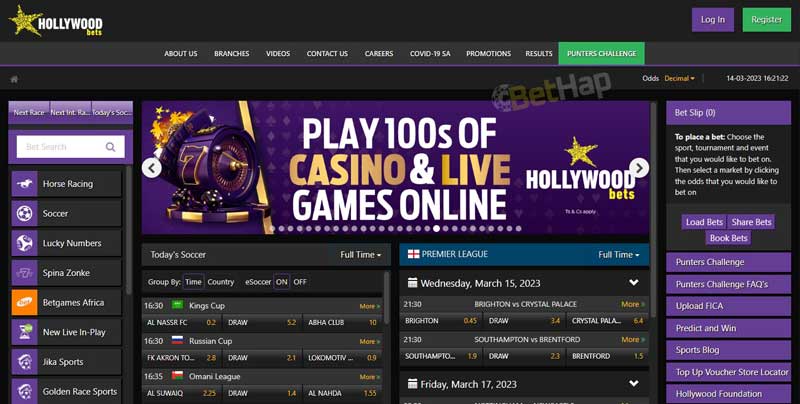

- Right here we’re going to show you which profile are the most widely used site inside every part of the globe while the lowest put casino numbers is actually handled a tiny differently inside for each and every place.

- For more information and the ways to enrol, see Head deposit – Canada Money Service.

Borrowing from the bank unions try low-cash financial institutions designed to provide any earnings it secure right back to help you people, while antique banking institutions generally https://vogueplay.com/ca/payment-methods/ earn funds to own shareholders. Really credit unions limit that will subscribe by workplace or geographic city, however, common registration borrowing from the bank unions provide all the You.S. owners a means to are a member. These credit unions make use of the shared branch program to give better across the country inside the-person banking access, however the power to open membership in the those individuals common twigs you will become minimal.

Calculating the newest income tax

Landlords who have fun with illegal solutions to push a tenant to maneuver are susceptible to each other unlawful and you will municipal charges. Subsequent, the brand new occupant is generally entitled to end up being recovered so you can occupancy (RPAPL 768; RPAPL § 853; New york Administrator. Password § , § ). When a renter is evicted the fresh property manager have to provide the tenant a fair length of time to get rid of all of the house. The new property manager may well not retain the renter’s private home otherwise furniture (RPAPL §749; Real estate Law § 235).

They lists the brand new standards less than and this products might be brought in to your Canada without paying the new GST/HST in the course of importation. The brand new laws and regulations offer recovery in the points in which the products stay static in Canada, and some examples in which goods are temporarily imported on the Canada. Industrial products imported for the Canada are often subject to the new GST and/or federal area of the HST. But not, in some issues such importing merchandise to own a temporary several months, limited or complete relief from the newest GST or perhaps the government area of one’s HST may be readily available. For those who import items briefly, you will want to get in touch with a good CBSA place of work to determine if the relief terms apply to your position. Multiple relief conditions are available for brief importations from particular categories of goods.

Yet not, Regal Las vegas Gambling enterprise would not let you down making use of their complete video game possibilities after you are completing and ready to try something else entirely. That it brief deposit online casino might have been common for a long go out largely from the huge number from headings he has on the finest team from the video game. The fundamental tip behind the absolute minimum put gambling enterprises $5 totally free spins incentive is you collect an appartment out of 100 percent free chances to hit wins for the a popular position. Since these are some of the extremely played game as much as, it is frequently the situation one to players could have been playing them to start with. Which is many away from why they have been so popular, but because you could winnings real cash earnings from all of these incentives, you can realise why players like her or him such from the $5 minimum deposit local casino websites. All local casino desires to make sure their people getting appreciated, especially when it basic register.

Game play Resident $5 put

For lots more information on the desired supporting documents, relief from punishment and desire, or any other related versions and you may publications, go to Terminate otherwise waive penalties or focus. The brand new CRA discernment to give recovery is bound to your several months you to ends in this ten schedule ages through to the year in which a reduction demand is established. The fresh CRA administers laws, aren’t titled taxpayer rescue conditions, enabling the newest CRA discernment to help you cancel otherwise waive penalties and attention when taxpayers never fulfill its taxation debt because of items past their handle. To find out more, go to Provider viewpoints, objections, is attractive, conflicts, and you can save actions. To find out more from the objections and you may related deadlines, check out Solution views, arguments, is attractive, issues, and you may save actions. There is the directly to document a proper conflict for those who differ that have an assessment, determination, or choice.